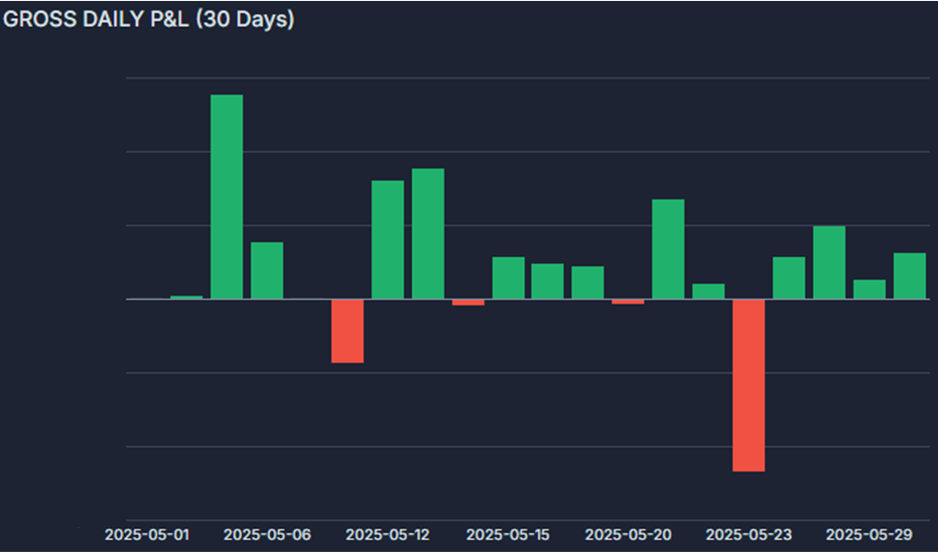

Slower start to the month, and things never really picked up steam during the first two weeks. I was fairly consistent, with only two very small red days, but never managed to land any big green ones either. I finally pulled the trigger and transitioned from IB to Guardian for better access to HTB small caps — a move I’d been considering for a while.

I knew this switch would limit my potential in the second half of the month since I had to set up DAS, familiarize myself with the platform, and transition from keyboard to Stream Deck — another change I’d been meaning to make. Because of this, I drastically reduced my risk (to about 20% of normal size). I gradually began sizing up again during the last week and plan to return to full size in the first week of June.

Towards the end of the month, I had one larger red day where I overtraded badly and spiraled a bit. More on that later, but overall, this month was incredibly difficult for my bread-and-butter setups — mean reversion and parabolic reversals. Small caps in particular often had way more legs than expected in a “normal” environment. Tops were choppier and less clean, and follow-through on winners was limited, making it hard to gauge whether to hold for a deeper retracement or protect unrealized gains more aggressively. Naturally, that made it harder to recover frontside losses and called for greater selectivity — which I clearly lacked on some days.

One major contributor was my increased trading on the faster 1-minute chart, which led me to get too trigger-happy. On that big red day, for example, I had 2 winners and 14 losers — which is absurd and completely unacceptable.

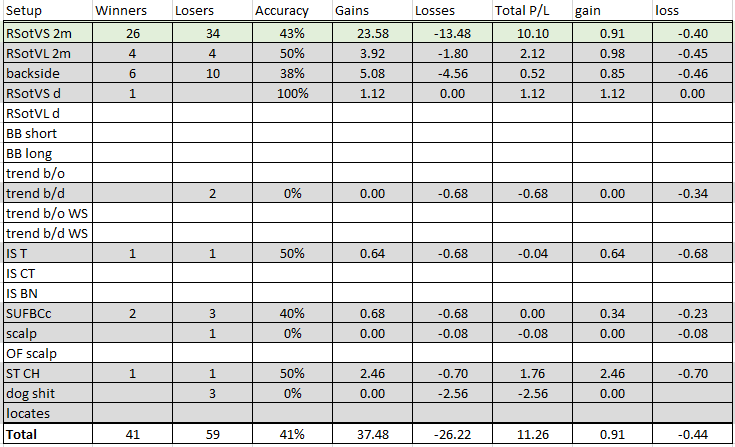

Average winning trade +0.91R, average losing trade -0.44R

Average position MFE +0.56R, average position MAE -0.27R

Profit factor 1.43

I’ll include a more detailed breakdown of my Tradervue stats toward the end of this review. I needed more clarity on what was actually working and where I was going wrong, because this month often felt like an uphill battle — and I couldn’t blame it solely on the environment. There are always multiple components to that equation.

As I mentioned earlier, the raw stats tell part of the story — but not the whole picture. In my DRCs, I tend to combine multiple attempts on the same setup, whereas in Tradervue, every trade is logged individually. Without that consolidation, my win rate for the month was just 33.6% (51 winners vs. 101 losers). I’m not a high win-rate trader to begin with — tight stops are an integral part of my strategy — but 33% is extreme, even for me. The only reason I ended the month green at all is because I did a much better job letting my winners run: my average winner on Tradervue was almost 3x the size of my average loser.

Still, a 33% win rate is glaring, and it clearly points to overtrading as the main issue. I had several days where I took 15–20 trades, whereas my longer-term average tends to be around 6–10.

Strategy-wise, I finished green across most of my playbooks, but the results were underwhelming. The “backside” setup I added this month definitely requires more refinement — selectivity is clearly key here as well, and I didn’t exercise enough of it. On top of that, the number of trades I took that fell into the “dog shit” category was too high. If I hadn’t bundled similar attempts together in my DRCs, that number would look even worse — again highlighting the core issue of overtrading.

These stats look solid, and I’m genuinely satisfied with them. My goal is to hit around 80% in each category, which isn’t always realistic — but getting this close across the board is a strong result. I was involved in most of the trades I should have taken and executed reasonably well overall, with only minor issues in execution and sizing.

The Biggest Losses & Key Insights

5/23/25 | PMAX RSotVS | -2.64R

5/23/25 | IMNN RSotVS | -1.88R

These were my two biggest losses of the month — both traded on the same day (5/23), which was also the day I racked up 2 wins and 14 losses. Classic case of degenerate overtrading on the fast timeframe. Key takeaways:

1. Dial back trading off the 1-minute chart and focus more on the 2-minute. The 1m should only be used for very obvious parabolic blowoffs — not as a default.

2. Limit the number of attempts, especially on early legs. From now on, I’ll allow myself only one bullet on the first leg of a move. That should enforce selectivity and help prevent the kind of spiral I had on 5/23.

My reversal approach is built on taking more risk the more legs a stock makes, since EV improves with increased extension. I can handle 4–5 consecutive frontside losses and still come out ahead if I nail the turn — but that shouldn't be the norm. That kind of approach should be reserved for only the highest-quality setups.

5/8/25 | QQQ RSotVS & dog shit | -1.68R

This was the second time Trump tweeted “now is a good time to buy stocks.” I figured the market wouldn’t rally again on that — wrong. Thought I stayed patient and waited for what felt like extreme extension before shorting calls on the Qs. Got bagged twice in quick succession and walked away frustrated. Fading the first leg of a move on a major index, in response to a significant catalyst — not a good idea.

5/1/25 | SOPA backside | -1.46R

Tried fading the first lower high on a DCB daily setup. I don’t necessarily hate the trade, but it’s a good example of how I shouldn’t be approaching backside trades. If I’m adding to a position after trimming profits and already being in from a higher average, that’s one thing. But initiating a backside trade like this requires a real parabolic move — not just a decent-sized leg. Accuracy on these tends to be much worse, especially in a strong SC cycle where names often break to new highs even after seemingly topping out.

5/7/25 AAPL (& GOOGL) | RSotVL | -1.12R

Lost more than I should have between these two. Breaking news hit large caps, and I tried to fade the move — too early, too many times, without real capitulation. It’s a mistake I’ve made before. Fading large caps with huge institutional ownership is a whole different game compared to small caps. If someone with size is unloading, the stock can just keep melting lower. Patience is key before stepping in for a mean reversion play. UNH was another good example of this dynamic.

The Biggest Wins & Key Insights

5/1/25 CEP | RSotVS d | +5.36R

Daily blowoff top on the second leg. Took weekly $30 strike puts — not a super technical entry, just a solid probabilistic bet with limited risk. Trimmed into weakness over the next two days and also shorted equity in the PM on 5/5, which I covered into the open. Haven’t seen many clean parabolic moves on LCs this year, but this was one of the few textbook examples.

5/12/25 CTMX | RSotVS | +2.34R

Classic parabolic blowoff on a two-legged move in the PM. Caught the turn on the tape, scaled out into weakness, and trailed a break of trend. It ended up trading lower after the open, but holding through that would’ve meant enduring a larger spike. The way I approach these — precise entry, aiming to catch the highest-probability leg while keeping a relatively tight leash — doesn’t justify holding unless it’s an absurdly extended setup.

5/13/25 FSLR | RSotVS | +2.3R

Rare OD mean reversion attempt on a large cap. Had been melting higher since the prior day and blew off at the open. Shorted the turn, held through the first LH, and scaled out into weakness while trailing the trade with a break of trend. Staying selective is key here — fading the first leg after the open on an LC requires a truly exceptional move (think HIMS-level extension).

5/28/25 ILAG | RSotVS | +2.06R

Best penny stock reversal I had this month — and a segment I’ve only recently started exploring. Biggest takeaway so far: once these top, they often give it all back, so being more patient on PT and holding more size for a full round trip seems to be the move. They also tend to form cleaner backsides than “standard” small caps, making trend structure more reliable and allowing for better trailing on larger portions of the position.

The Biggest Missed Opps & Key Insights

UNH 5/15/25 | RSotVL d

Incredible multi-week capitulation on one of the 15 largest publicly traded companies in the world — not something you see every day. I gave it a shot once on the OD reversal and hit out flat. The price action that followed was tricky and exactly the kind I’ve sworn off trying to fade: slow, grindy, and full of churn, with a heavy tape that clearly indicated institutional selling. In hindsight, I’m fine with not re-entering for a day trade, but this was right up my alley for an overnight setup, and I don’t really know why I didn’t pull the trigger. The odds of a reversal that day were overwhelming, and not getting involved wasn’t really an option. The benefit of a smaller swing position with wider risk is being able to take a bigger-picture approach without relying on precise entries — and I missed that.

SC longs

The SC market has been on fire, with multi-100% movers showing up daily — sometimes even several in a single session. I’d started developing a small cap long playbook in previous months, and there were plenty of opportunities in May too, but for some reason I focused more on mean reversion than trend following. I passed on many clean flag breaks early in the move.

Breaking news trades

I’m not a breaking news trader and don’t plan on developing that playbook just yet. That said, May offered incredible opportunity in this category — especially on crypto treasury headlines. Almost without exception, these names saw massive initial spikes, often several hundred percent. Some faded quickly, others pushed higher, but the first leg was almost always a sharp upside move, making it a very high-probability long for anyone fast and specialized enough.

Key Lessons From DRCs

On HTB shorts & the SC cycle:

Small cap shorts have been incredibly tough. Market makers have gotten (even more) sophisticated, and the space has become (even more) crowded. We’ve seen more legs than usual, logical reversal spots that haven’t worked or turned into classic short traps, and even blowoff tops into LDs that ended up grinding back to new highs — think SYTA or IMNN — followed by a HOD swipe that finally marked the top.

All of this calls for increased selectivity until sentiment shifts — which it always does eventually. The frustration on Twitter is palpable, and that in itself is often a signal that we’re closer to the end of the cycle than the beginning. It’s just a matter of time.

On sizing:

The truth is, staying stuck at the same risk level has real consequences over time. It limits both PnL growth and psychological progress. Trading is one of the few careers where you get paid in direct proportion to your ability to lean into discomfort with precision and discipline. If I keep hesitating to size up on the highest-quality setups—the ones I’ve trained for, built playbooks around, and seen work over and over again—I’m effectively capping my own potential.

It creates this false sense of safety that feels good in the moment but adds up to stagnation in the long run. The market doesn’t hand out clean A+ setups every day, so when they do show up, it’s not just an opportunity—it’s a responsibility. And if I continue to play small in those moments, I’ll end up running in place while others with more conviction pass me by. This isn't about swinging big recklessly—it's about stepping into earned risk when the data supports it, which mine clearly does.

On LC reversals:

Headline Fatigue Doesn’t Equal Reversal Readiness: GOOG and AAPL both sold off on what felt like stale or overstated headlines. While tempting to fade on "logic," price action showed that sentiment and positioning still matter more than headline validity. The market's reaction—not your interpretation of the news—is what drives trades.

Capitulation Structure Is Essential: GOOG lacked the volume and price action typical of a true flush. Without that, early fades are fighting trend. NVDA, in contrast, offered a structured breakout with volume confirmation, making pullback entries more viable.

Systematic Entries Outperform "Cute" Ones: Across multiple names, the lesson repeated—intrabar entries (especially bottom-picking) often led to stops. More systematic setups, like waiting for a clean 2m or 5m PBH reclaim, provided more reliable structure and risk control.

Respect the Timeframe and Limit Attempts: Multiple failed entries in tight ranges burned capital and focus. Going forward, capping reversal attempts to two per timeframe keeps discipline intact and avoids overtrading.

News Moves in Large Caps Are Stickier: LC reversals are less about fast, picture-perfect turns and more about recognizing when structure and participation are actually shifting. They often require more patience, cleaner confirmation, and a longer leash.

On backside trades:

Backside trades require bigger-picture structure and patience — not just a tape read and a lower high.

Wider stops and smaller size are acceptable on these, but entries still need to be high-quality.

There’s real opportunity in momentum adds with tighter stops once the backside structure is established — I need to be more intentional with those rather than reactive.

Profit targets need to be aligned with the bigger picture — most of these should be fading back toward the base, and I need to hold accordingly.

Backside shorts on penny stocks right after one smaller leg aren’t good enough — I need a full blowoff to justify taking entries that aren’t my tried-and-true reversal entries. That means multiple legs, real volume expansion, and a heavy tape on the first bounce attempt.

Key Lessons From tradervue Stats on MR

Catalyst vs. No Catalyst

Catalyst: 41.5% accuracy | PF 1.81

No Catalyst: 47.1% accuracy | PF 2.49

Not unexpected. There tends to be much better follow-through on names that have no business trading where they are. Once they top, they’re often done for. Clean backside action and fewer variables to account for make these easier to manage.

Frontside (FS) vs. Backside (BS) Entries

FS: 40.7% accuracy | PF 2.41

BS: 46.2% accuracy | PF 1.20

Somewhat surprising. Turns out intrabar entries — usually on the frontside — are outperforming backside confirmation setups like break-of-PBL entries. The lower accuracy on FS is made up for by significantly larger winners. Tape reading clearly plays an integral role here.

Entry by leg of move

Leg 1: 48.6% accuracy | PF 2.58

Leg 2: 45.2% accuracy | PF 2.27

Leg 3+: 36.7% accuracy | PF 0.61

Very surprising. I would’ve expected much better results on extended names, especially given my strategy. But it’s likely a function of the current environment, where expert MMs make sticking shorts on Leg 3+ nearly impossible. The key is recognizing these tickers early, cutting attempts quickly, and waiting for a real blowoff — or sitting out entirely. Meanwhile, simpler “pop and drop” setups have worked well and often retrace most (if not all) of the move.

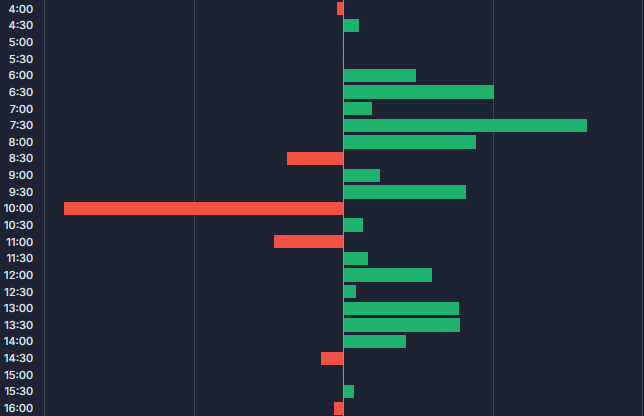

Time of day:

There’s solid edge in the PM and later in the day, but the first hour after the open continues to be a problem area. That’s when many of the bigger squeezes have occurred, and I haven’t been nearly selective enough during that window.

Performance by price:

I’ve performed well on the cheaper names, but I’ve struggled in the $10–$20 price range — where some of the largest moves have occurred and the price action has been the most stubborn.

Closing Thoughts

May was a grind. While there were pockets of opportunity — particularly in crowded, overextended low-float names — the overall environment made it tough to extract clean moves. Many setups lacked follow-through, tape was erratic, and strong fades often turned into frustrating reclaim rallies. A few decent green stretches were overshadowed by unnecessary drawdowns, most notably a -5.9R day that forced a hard reset in mindset and approach.

I’m enforcing the “one shot” rule on first legs. Stats show that taking stabs early can work — but what doesn’t is trying again and again after getting stopped. Both P&L and mental clarity will benefit from stricter discipline here.

I’m also reframing my risk-reward mindset in chop. In this kind of tape, full roundtrips are rare. I should consider taking partials quicker and adapt to what’s actually working — especially when I’m sitting on 2R+ unrealized. I need to better define when to trail and when to lock in a small win in exchange for reduced variance.

At the same time, I have to avoid overcorrecting. After big red days, I tend to swing too far the other way — passing on solid setups or trimming too early. Resetting is good, but it can’t turn into paralysis. The goal is to find a more balanced middle ground.

June should be about refining selectivity, trusting my edge on high-probability setups, and walking away when it’s not there. The goal isn’t perfection — it’s consistency.